AP Invoice Payment: Check Pick Ups, Special Handling, & Holds on Invoices

Special Handling of Checks and Holds on Invoices

To place an invoice on hold, follow these instructions:

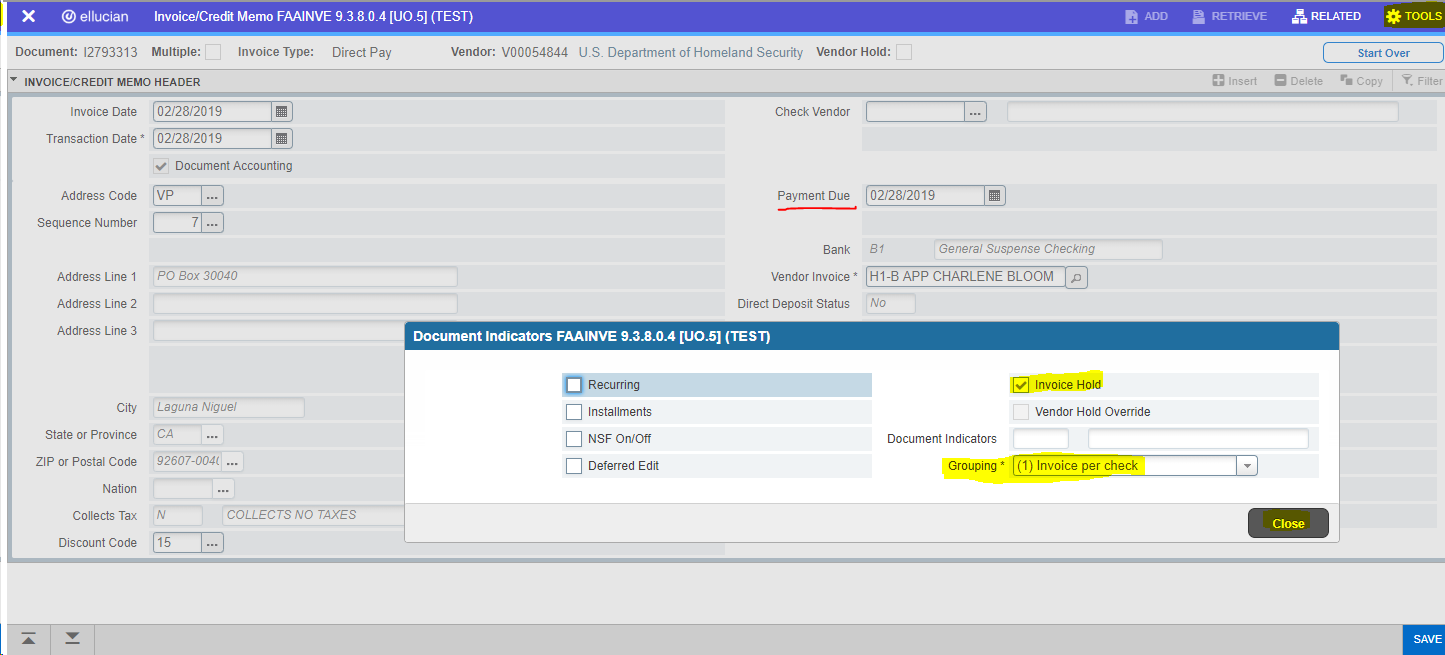

- Enter an invoice payment into Banner (FAAINVE). Fill in the Invoice/Credit Memo header (first page) making sure the pay date reflects the date of the check run that you need the payment by, then click on TOOLS Menu and under Options, select View Document Indicators. Change the Grouping from (M)any invocies per check to (1) Invoice per check and click the 'Hold' box. (Do not use the 'Hold' box on the Commodity Information section. This box here should never be used and could delay the printing of a check).

2. There are two reasons for putting a Banner invoice on HOLD.

Sending documentation with a check: When documentation such as a letter, subscription/membership renewal or registration form needs to be mailed with a check. Send your request and documentation (per instructions below) to Accounts Payable by campus mail, email to apbao@uoregon.edu, or fax to 346-2393:

- Banner document number should be clearly written on your letter, subscription/membership renewal, registration form or other documentation needing to be enclosed with check along with the word HOLD.

- Include your name and extension in case AP has any questions about your special handling request.

- Send documentation by 4:00 p.m. prior to the date you need the check mailed to allow time for AP to release the HOLD on the Banner invoice for the check to print on the Tuesday or Friday check run date closest to the date you need to have the check mailed.

- Make sure you override the payment due date to reflect the date you need the check to print and be mailed. (Please note printed check runs are only on Tuesdays and Fridays).

Picking up a Check: On rare occasions you may need to have a check held for pickup. Send your request to pick up a check (per the instructions) below to Accounts Payable by campus mail, email to apbao@uoregon.edu, or fax to 346-2393. The person picking up the check will need to bring a picture ID. Your request should inlude:

- Message: "Hold check for pickup"

- Banner document number

- Vendor name

- Amount

- Your name and extension

- Name and extension of individual who will pickup check (if different).

- Date needed

- Please send request by 4:00 p.m. to allow time for A/P to release the hold on the Banner invoice for the check to print on the Tuesday or Friday check run date prior to the date you need the check picked up.

- Make sure you override the payment due date to reflect the date of the check run prior to the date you need to pick the check up. (Please note printed check runs are only on Tuesdays and Fridays).

- Upon receiving your request or documentation, Accounts Payable will release the HOLD on the Banner document and a check will be produced the next business day. Accounts Payable will then follow your instructions and either mail your documentation with the check or call the contact person when the check is ready for pick up.

- Generally, checks are not printed until after 10:00 am on check run days. Accounts Payable will call the contact person listed on your special handling request when the check is ready for pick up.

Example:

- Please hold check

- Banner I2793313.

- U.S. Department of Homeland Security

- $325.00.

- Daisy Duck at 6-XXXX

- Comet Duckcall will pick up check. Please call Comet Duckcall at 6-XXXX.

* Please note that when you put a document on hold, you are putting a hold on the Banner invoice so that a check will not be printed. You are not putting a hold on the check. A check will not be printed until we receive instructions or documentation from you. We do not review the text of every completed document and we do not know that a hold is on an invoice unless you notify us.

**For the people who are still in invoice training: Input the document in Banner, put it on hold, and forward everything to Accounts Payable as you usually do during invoice training. Please also send a copy of your hold or special handling request to Accounts Payable by campus mail, email to apbao@uoregon.edu, or fax to 346-2393.

If you have any questions, please call 346-1252 or via email at apbao@uoregon.edu.