How to read your earning statement

How to read your earnings statements ~

UO MyTrack training is available for details on reading an employee earning statement

https://uomytrack.pageuppeople.com/learning/3845

The University of Oregon’s paystub is broken into eight blocks. Each block provides a different type of information.

Header Information:

- Employer Name (University of Oregon).

- Employer Address and Phone Number.

- Employer Business Identification Number (BIN).

- Month and Year of Earnings.

- Actual Pay Date – the date the check/direct deposit was issued.

Employees who are paid hourly have a different pay period than those who are paid salaried. The pay period for hourly employees is always mid-month to mid-month, however, the actual begin and end dates are set within the department. For example, one department could have a pay period of the 16th-15th for their hourly employees while another department could have a pay period that runs the 14th-13th. All the departmental pay periods for hourly employees can be found at https://ba.uoregon.edu/payperiods. On the paystub example above, it states that it is for March 2018 earnings. If this was an hourly employee, the pay reflected here would be for the last part of February and the first part of March. The pay period for salaried employees always run from the 1st to the 31st of the month so in this example, if she was a salaried employee, the pay period would be March 1st-31st.

Employee Information:

- Year - Year of Earnings.

- Pict Code – Code used by Banner.

- Pay Id – Month of Earnings. (3 = March, 4 = April, etc…)

- Seq No – The number of pay events for that month and year. (0 = Original pay event)

- ID - Employees UO ID Number.

- Employees W-4 Filing Status, Withholding Allowances, and Additional Withholding Amount, if any. It also shows the year to date subject wages for both Federal and Oregon State tax.

Paycheck Summary – All three items in this block display the amounts specific to that pay event as well as year to date totals.

- Gross Pay - Earnings before any deductions are taken out. Details are displayed in the Earnings section of the pay stub.

- Employee Deductions – total of all voluntary and mandatory deductions. Details are displayed in the Deductions section of the pay stub.

- Net Pay – The amount of money you receive after all deductions have been taken out. This is the amount that is distributed to you through direct deposit or paper check.

Employee Mailing Address:

- Employees Home Department – Six-digit identifier for the employee’s home department and the title of that department.

- Employees Name – The employee’s legal name as it appears in Banner.

- Employees Mailing Address – As it appears in Banner.

Net Pay Distribution:

- Displays the check number and amount if employee is receiving a paper check.

OR

- Displays “Bank Deposit # 1” and the amount if employee is receiving a direct deposit. If the employee divides their net pay amongst multiple bank accounts then there will be multiple lines in this box. The description for those additional lines will be “Bank Deposit #2” and so on.

Leave:

- For each leave type (vacation, sick, comp, personal) this section displays the amounts taken and accrued in the current pay event as well as the leave balances reflected in Banner.

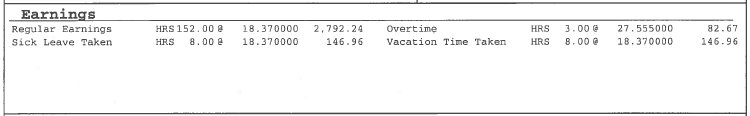

Earnings:

- This section includes a short description of the type of earnings.

- The hours/units reported for each type of earnings.

- The rate of pay for each type of earnings. There is not a rate displayed for salaried earnings associated with exempt employees.

- The gross amount associated with each type of earnings.

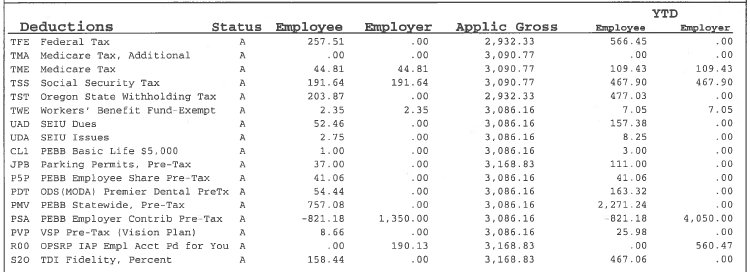

Deductions:

- Column titled “Deductions” - Three character code used in Banner to identify the type of deductions and a description of the deduction.

- Column titled “Status” - Deduction status at the time of the pay event. A = Active, T= Terminated, W=Waived, E=Exempt.

- Column titled “Employee” - The amount for each deduction that was withheld from the gross pay. If the amount is negative then it is being added to the gross pay.

- Column titled “Employer” - The amount that the university pays for medical and retirement benefits as well as mandatory taxes.

- Column titled “Applic Gross” - The applicable gross is the amount that the deduction is calculated against.

- The last two columns display the year to date totals for both the employee and employer paid deductions.

Comments: (There is no Comments section on the paystub printed from Duckweb)

- Contains the web link for the pay period dates of each department.

Additional Deduction Information

Both mandatory and voluntary deductions may be withheld from an employee’s paycheck. Mandatory deductions are required by law and include Federal Income Tax, State Income Tax, Social Security, Medicare, and Workers’ Benefit Fund Tax. Voluntary deductions are elected by the employee and include Pre-Tax Parking, Medical and Dental Premiums, Tax Deferred Investments, and Charitable Fund Drive Donations.

Employee CORE Health Insurance Benefits

The University of Oregon offers, to all eligible employees, a CORE benefit package which provides medical, dental, vision, and life insurance coverage. The university covers the majority of the cost, with the employee sharing a percentage of the total expense based on position status, employee classification, and plan selection. Most employees pay 5% of the monthly healthcare premiums for themselves and eligible dependents.

The CORE benefit package includes:

| Benefit | Deduction Code |

| Employee basic life insurance | CL1 |

| Dental insurance* | PD_ |

| Medical insurance* | PM_ |

| Vision | PVP |

| Employee 5%/3% premium share** | P5P/P3P |

| Employer contribution*** | PSA |

| PEBB, HEM Incentive**** | PIH |

| Benefit subsidy for part-time classified employees enrolled in a part-time plan | PST |

| Opt-out in place of medical insurance | POO |

| $40 Premium subsidy***** | P40 |

*Deduction codes are three characters long and identify the plan selection. Dental plans start with a “PD” and medical plans start with a “PM”.

**Employees pay either 5% or 3% of their CORE benefit premium costs.

- Part time employees may have additional out of pocket costs, not reflected in the 5%/3% employer premium share deduction code, for their CORE benefits because their employer contribution is prorated based on the number of hours worked/paid in the pay period. To determine the total employee cost, add the amounts listed under the above codes together.

***For full-time classified and .50+ FTE faculty and OA’s, this amount displays 100% of the premium costs associated with their CORE benefits. The employees cost is shown under the 5%/3% employer premium share deduction code (P5P/P3P). The employer contribution for part-time classified employees is prorated based on the number of hours worked/paid in the pay period.

****The PEBB, HEM Incentive is a cashback incentive for employees who elect to participate in the HEM program. They receive $17.50 each month to reduce their out of pocket costs. This shows as a negative amount on the paystub.

*****Full-time classified employees with salary rates less than or equal to $2,885 a month or $16.65/hr can qualify for an additional monthly subsidy of up to $40.

If you cover a domestic partner on your CORE benefit package and are required to pay taxes on the imputed value of that coverage, you will see it reflected as additional taxable income in the Earnings section of your paystub.

Employees may also sign up for additional optional benefits through PEBB, such as employee, spouse or dependent life insurance (deduction codes CL2, CL3, CL5, CL6, L02, L03, and L06), accidental death and dismemberment insurance (LAE or LAF), disability insurance (LST and LTD), and flexible spending accounts (PXM, PXS, PXK, and PXL). These are not included in the CORE benefit package and are deducted from the employee’s pay.

On the sample paystub above, the employee is a full-time classified employee who chose the PEBB Statewide Plan for medical and ODS Premier for dental. To determine the employees cost for the CORE benefits package, add the following deduction codes together:

| Deduction Code | Description | Employee | Employer |

| CL1 | PEBB Basic Life $5,000 | 1.00 | 0.00 |

| P5P | PEBB Employee Share Pre-Tax | 41.06 | 0.00 |

| PDT | ODS(MODA) Premier Dental PreTx | 54.44 | 0.00 |

| PMV | PEBB Statewide, Pre-Tax | 757.08 | 0.00 |

| PSA | PEBB Employer Contrib Pre-Tax | -821.18 | 1,350.00 |

| PVP | VSP Pre-Tax (Vision Plan) | 8.66 | 0.00 |

| Total cost to employee for CORE benefits package | 41.06 |

Retirement Deductions

Employees may be eligible for retirement contributions, paid for by the UO, if they meet the eligibility requirements. Eligible classified employees are automatically enrolled in Public Employees Retirement System(PERS)/Oregon Public Service Retirement Plan(OPSRP). Faculty and OA’s are given a one-time irrevocable choice between PERS/OPSRP and the Optional Retirement Plan (ORP). Eligible employees receive an employee contribution, paid for by the UO, which appears in the Deductions section of the paystub. The PERS/OPSRP and ORP deduction codes begin with an “R” and the contribution amount is shown under the “Employer” column. For additional information on eligibility please reference https://hr.uoregon.edu/benefits/retirement.

Employees may also enroll in additional voluntary retirement savings through either a Tax Deferred Investment 403(b) Plan or the Oregon Savings Growth 457 Plan. These deduction codes begin with an “S” and the contribution amount is shown under the “Employee” column.

Workers’ Benefit Fund Tax

This tax assessment is paid to the State of Oregon which funds “Return to Work” programs, provides increased benefits over time for workers permanently and totally disabled, and gives benefits to families of workers who die from workplace injuries or diseases. All employees are required to pay this tax which is assessed on the number of hours worked. The deduction codes for this tax are TWC (non-exempt employees) and TWE (exempt employees).

Federal and State Income Tax

The amount of income tax withholding is determined by the status and number of allowances selected on the employees Form W-4 in conjunction with the formulas provided by the Federal and State governments. If no Form W-4 is filed, the default is 'Single' status with zero allowances.

Social Security and Medicare Tax (FICA)

Social Security and Medicare tax are based on percentage rates set by the Federal government. Yearly maximums are set for Social Security subject wages. Once the maximum has been reached for that calendar year, no more Social Security tax will be withheld until January 1st of the following year.

NOTE - The PDF version of your earning statements are viewable on Duckweb regardless of whether you have chosen to go paperless or not. You will continue to have access to your earning statements and W-2's in Duckweb after seperation from the university.