Account codes define the type of activity being recorded in a transaction such as revenue, expense, and transfers in the operating ledger and assets, liabilities, and fund balance in the general ledger.

Knowledge of account codes is important for both reporting on accounting data and for entering financial transactions into the system. It also allows Business Affairs time to review purchasing information and trends. Some commonly used account code groups are listed below.

| Account Code | Type | Description |

|---|

| 0XXXX | Revenue | To record revenue for sales, services, rentals, and fines to customers outside the UO. Generally used when making a deposit through Cashiers. |

| 09XXX | Internal Revenue | To record revenue for internal sales and services provided to other UO departments. |

| 1XXXX | Payroll | To record payroll expense. Generally used only through the payroll sysytem. |

| 2XXXX | General Expense | To record expense for services and supplies. |

| 3XXXX | Travel Expense | To record travel expense. |

| 4XXXX | Capital Expense (Non-Proprietary) | To record capital outlay (purchase or construction) for non-expendable personal property and real property from non-proprietary funds. |

| 5XXXX | Student Aid | To record expense related to scholarships, fellowships, grants-in-aid, waivers of fees and participant support for UO students. |

| 6XXXX | Merchandise for Resale | To record the purchase of merchandise for resale. |

| 70XXX | Indirect Costs | To record indirect costs. |

| 79XXX | Internal Sales Reimbursements | To record internal sales reimbursements for sales and services from the General Fund (001100) and the ICC Credits Fund (001700) to other UO departments. |

| 8XXXX | Student Loan-Related Expense | To record student loan fund receipts and expenditures for loan funds. BA use only. |

| 9XXXX | Transfers | To move cash between funds when there is not an exchange transaction. Also used to move fund balance created by prior year's activity. |

| A8XXX | Capital Expense (Proprietary) | To record capital outlay (purchase or construction) for non-expendable personal property and real property from proprietary funds. |

Supplies (20XXX)

Communications & Postage and Shipping (220XX & 225XX)

Facilities & Utilities Related (230XX, 233XX, 235XX, and 240XX)

Fees and Services (245XX-249XX)

Conferences, Entertainment, etc. (286XX)Travel (393XX-397XX)

Summary of Tax Reportable Account Codes (various)

These codes are in the 20XXX's. Supplies and equipment payments make up the majority of FIS invoice payments. When paying for these, it is important to understand the distinction between these two categories as defined below:

Equipment - something that lasts for several years including calculators, chairs, and furniture.Supplies - something that is used up relatively quickly including paper, pencils, and paper clips.

The two main general supply codes are also broken down according to Administration and Instruction as shown below:

20101 Office and Administrative Supplies - for Administrative purposes.20102 General Operating Supplies - for Academic instruction purposes.

The most general equipment code is shown below:

20200 Minor Equipment - <$5,000

Equipment costing more than $5,000 is capitalized. Capitalized equipment should be coded with the capital outlay codes - 40X Non-Proprietary or A8X Proprietary.

Note: If you are simply reimbursing an employee for purchasing supplies and equipment rather than paying the vendor directly for them, you would use 28994 Reimbursement S&S Exp - Employees.

These codes are in the 225XX's. The most common valid codes include the following:

22505 Express Mail - For UPS, etc.22511 Freight/Moving-Not Employee Related - for shipping charges22599 Miscellaneous Postage and Shipping - for other misc mail-related expenses.

Be careful using Postage:

22502 Postage (is for stamps or US postage charges only)

You will generally NOT use:

22521 Delivery Service (for internal delivery only)

These codes are in the 235XX's. Maintenance expense codes may be broken down according to whether or not the vendor is doing work on contract. See the following:

23501 Equipment Maintenance and Repairs (tax reportable)23510 Contract Maintenance and Repair - Equipment (tax reportable)

Be sure NOT to use the code 23599 Miscellaneous Maintenance and Repairs because it is not tax reportable. Use 23501 Equipment Maintenance and Repairs (tax reportable) if you cannot find a more specific one.

These codes are in the 240XX's. Here's a tricky one - if you rent out a room or facility, use the code 24151 Building - Rentals (tax reportable).

Be sure NOT to use the code 24199 Miscellaneous Rentals because it is not tax reportable. Use 24101 Equipment - Rentals (tax reportable) if you cannot find a more specific one.

These codes are in the (245XX-249XX)'s. These should usually be tax reportable. Some of the more common ones include the following:

24503 Data Processing Service (tax reportable)24611 Advertising - Personnel Recruitment/Bid Solicitation/Public Notices (tax reportable)24612 Advertising - Institutional Promotion/Public Relations (tax reportable)24602 Duplicating and Copying (tax reportable)24606 Printing and Publishing (tax reportable)

Be sure NOT to use the code 24999 Miscellaneous Fees and Services because it is not tax reportable. Use 24599 Other Professional Services (tax reportable) if you cannot find a more specific one.

If you are reimbursing an employee for purchasing supplies and equipment* rather than paying the vendor directly for them, you should use:

28994 Reimbursement S&S Exp - Employees

When reimbursing for entertaining, you should use 28612 Hosting Groups and Guests.

*Note: Reimbursements for equipment, especially electronic equipment is strongly discouraged as many warrantees do not transfer from the original party to the University. As this diminishes the product value and could leave you hanging if the product has problems, we recommend that you buy directly using your procurement card or purchase order.

(Don't use!)

Several problems are caused by the overuse of the miscellaneous codes. Please try to find and utilize the more specific ones. The following are some suggestions of codes to use instead of miscellaneous when you are not able to find a more specific code:

| Miscellaneous Code | Better Alternatives |

|---|

20199 Miscellaneous Supplies

28999 Miscellaneous Services and Supplies | 20101 Office and Administrative Supplies, or

20102 General Operating Supplies (instructional) |

| 22599 Miscellaneous Postage and Shipping(You may still use this if you are assessed charges not directly related to a delivery) | 22505 Express Mail, or22511 Freight/Moving-Not Employee Related |

| 23599 Miscellaneous Maintenance and Repairs | 23501 Equipment Maintenance and Repairs(tax reportable) |

| 24199 Miscellaneous Rentals | 24101 Equipment - Rentals (tax reportable) |

| 24999 Miscellaneous Fees and Services | 24599 Other Professional Services (tax reportable) |

It is particularly important to use the appropriate account codes when creating FIS invoices to pay for services from a vendor. All UO vendor payments for services are tax reportable for that vendor. Our system must reflect accurate coding of tax reportable payments so that we may submit our year-end 1099 report to the IRS. You should always use a tax reportable account code when paying for services.

0XXXX Income. Use when making a departmental deposit, preparing a JV, or reimbursing Budgeted Operations for sales to outside entities.

1XXXX Payroll. Used only through the payroll system; except for a JV for prepaid expense accrual.

2XXXX Services and supplies expense. Use when processing vendor payments or JV s involving expense.

201XX-203XX Supplies and minor equipment

220XX Communications

225XX Postage and shipping

230XX Utilities

233XX Waste disposa

l235XX Maintenance and repairs

240XX Rentals and leases

245XX-249XX Fees and services

250XX-251XX Medical/scientific services and supplies

280XX-284XX Assessments

285XX Employee-related and 1099

286XX Conferences, entertainment, etc.

289XX Miscellaneous services and supplies

290XX Training

3XXXX Transfer and travel expense. Use 38XXX when transferring to other Oregon state agencies. Use 390XX-397XX for travel expense.

4XXXX Capital outlay expense. Use for equipment purchases and other capitalized expenses.

5XXXX Student aid. Use is not allowable from the General Fund.

6XXXX Merchandise for resale. Use when purchasing items that are to be sold. Not for use on storeroom inventory accounts.

70XXX Indirect costs. Do not use. (the Business Affairs or Grants and Contracts offices will arrange for proper charges).

79XXX Internal sales reimbursement. Use when reimbursing General Fund (001100) or Service Departments for OUS sales.

8XXXX Student loan expense. (BAO use only).

9XXXX Transfers. Most commonly used to fund equipment or building reserves.

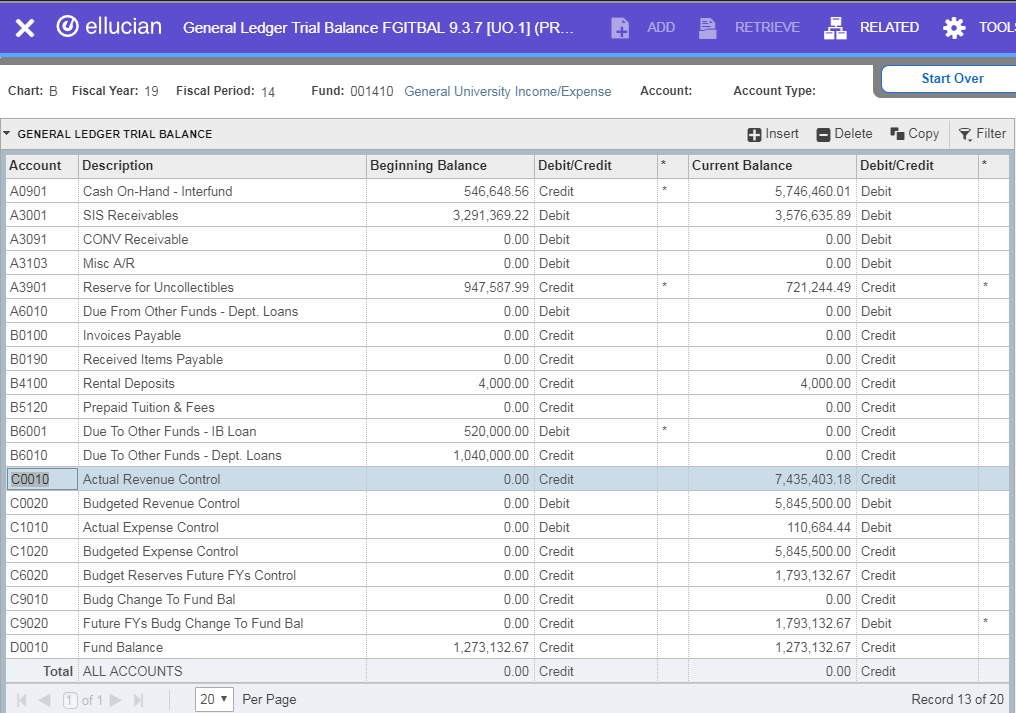

AXXXX Assets. Use for charges or payments to receivables, organized storeroom purchases and cost of goods sold, prepaid expense accruals, etc.

A0XXX (Cash) for Cashier's use only.

BXXXX Liabilities. Use for accruing payables, depositing prepaid income and refundable deposits. (Departmental deposits would generally use a revenue account code. 0XXXX):

CXXXX Control. Do not use. FIS automatically makes these entries.

DXXXX Fund balance. Do not use. FIS automatically makes these entries.

EXXXX Fund balance. Do not use. FIS automatically makes these entries.

FXXXX Fund balance. Do not use. FIS automatically makes these entries.

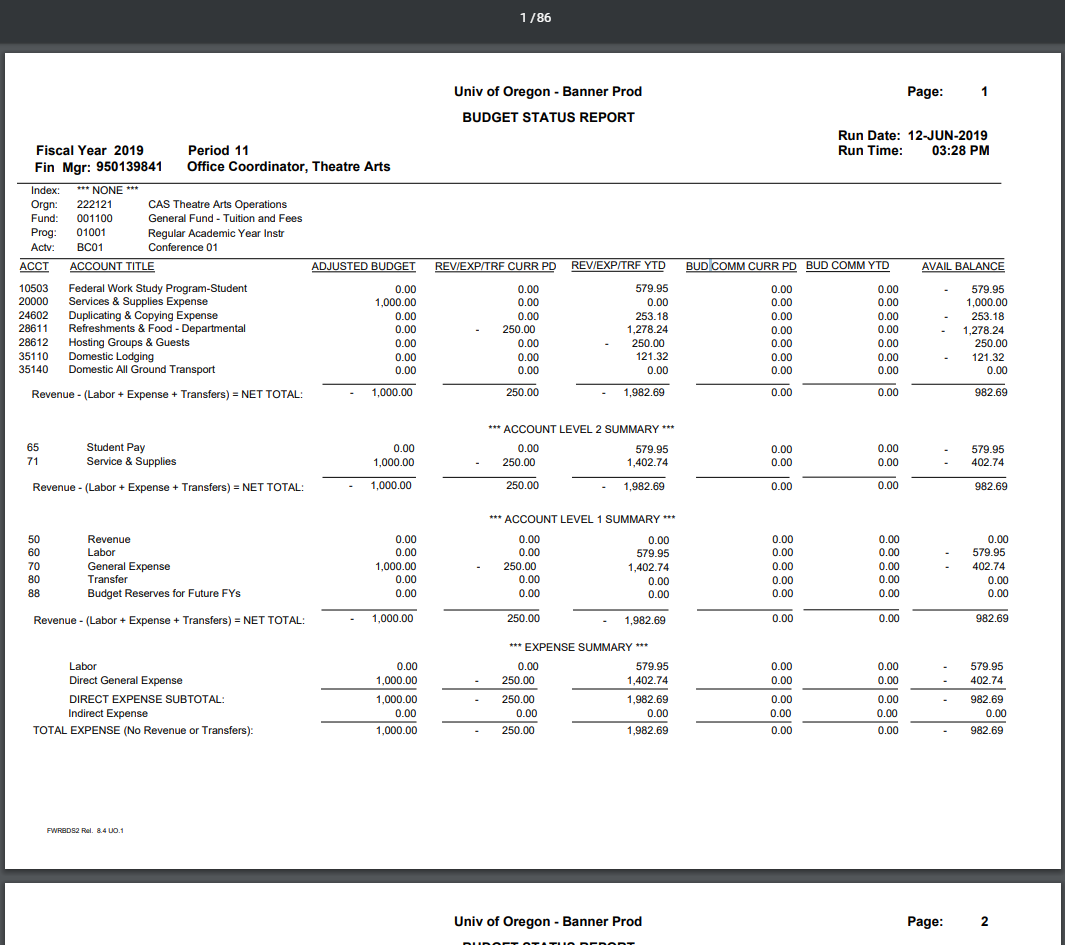

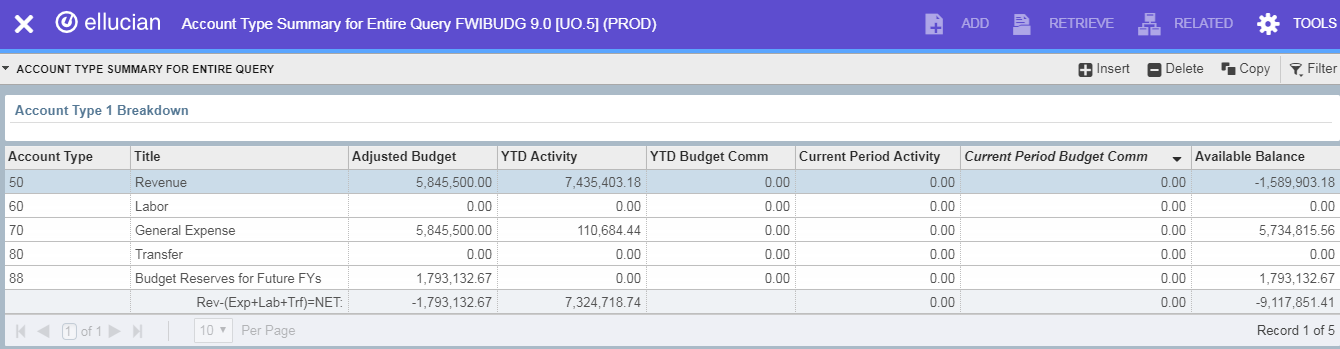

Operating Ledger Account Type Codes

| Type Code | Description |

| 50 | Revenue |

| 51 | Student Fees |

| 52 | Government Resources & Allocations |

| 53 | Gift Grants and Contracts |

| 54 | State Agency Tfrs In |

| 55 | Investment/Debt/Debt Serv |

| 56 | Sales and Services Revenue |

| 57 | Other Revenue |

| 58 | Student Loan Revenues |

| 59 | Internal Sales |

| 60 | Labor |

| 61 | Unclassified Salaries |

| 62 | Unclassified Pay |

| 63 | Classified Salaries |

| 64 | Classified Pay |

| 65 | Student Pay |

| 66 | Grad Ast Resdnt Phys Dentist Cl Fel |

| 67 | Benefit Compensation |

| 69 | Other Payroll Expenses |

| 70 | General Expense |

| 71 | Service & Supplies |

| 73 | Capital Outlay |

| 74 | Student Aid |

| 75 | Merchandise-Resale/Redistribution |

| 76 | Indirect Costs |

| 77 | Internal Sales Reimbursements |

| 78 | Depreciation/Amortization Expense |

| 79 | Student Loan Related Expense |

| 80 | Transfer |

| 81 | Interfund Transfers In |

| 82 | Interfund Transfers Out |

| 88 | Budget Reserves for Future FYs |

| 89 | Budget Reserves for Future FYs |

General Ledger Account Type Codes

| Type Code | Description |

| 10 | Assets |

| 11 | Cash |

| 12 | Investment |

| 13 | Receivables |

| 14 | Inventories |

| 15 | Prepaid Expense |

| 16 | Due From Other Funds |

| 18 | Capital Assets/Acc Depr/Amort |

| 19 | Deferred Outflows of Resources |

| 20 | Liabilities |

| 21 | Accounts Payable |

| 22 | Salaries & Wages Payable |

| 23 | Notes Payable |

| 24 | Bonds Payable |

| 25 | Deposits |

| 26 | Deferred Income |

| 27 | Due to Other Funds |

| 29 | Deferred Inflows of Resources |

| 30 | Control Accounts |

| 31 | Control Accounts-Debits |

| 32 | Control Accounts-Credits |

| 40 | Fund Balance |

| 41 | Fund Balance |

| 90 | Fund Additions |

| 91 | Fund Additions |

| 95 | Fund Deductions |

| 96 | Fund Deductions |