Payments to International Visitors and Individuals

- Notes for Using Check Vendor Function and Sending Checks Outside U.S.

- Payments or Reimbursements to International Individuals

- Background

- Terminology and some Common Visa Restrictions

- Treaty Benefits for Independent Personal Services (Form 8233)

- Table of Taxes, Travel Restrictions, and Documents Required for International Visitors

- W-8 Form: Setting up an International Individual Vendor in Banner

- Virtual Services

- Form 1042-s for Foreign Vendors

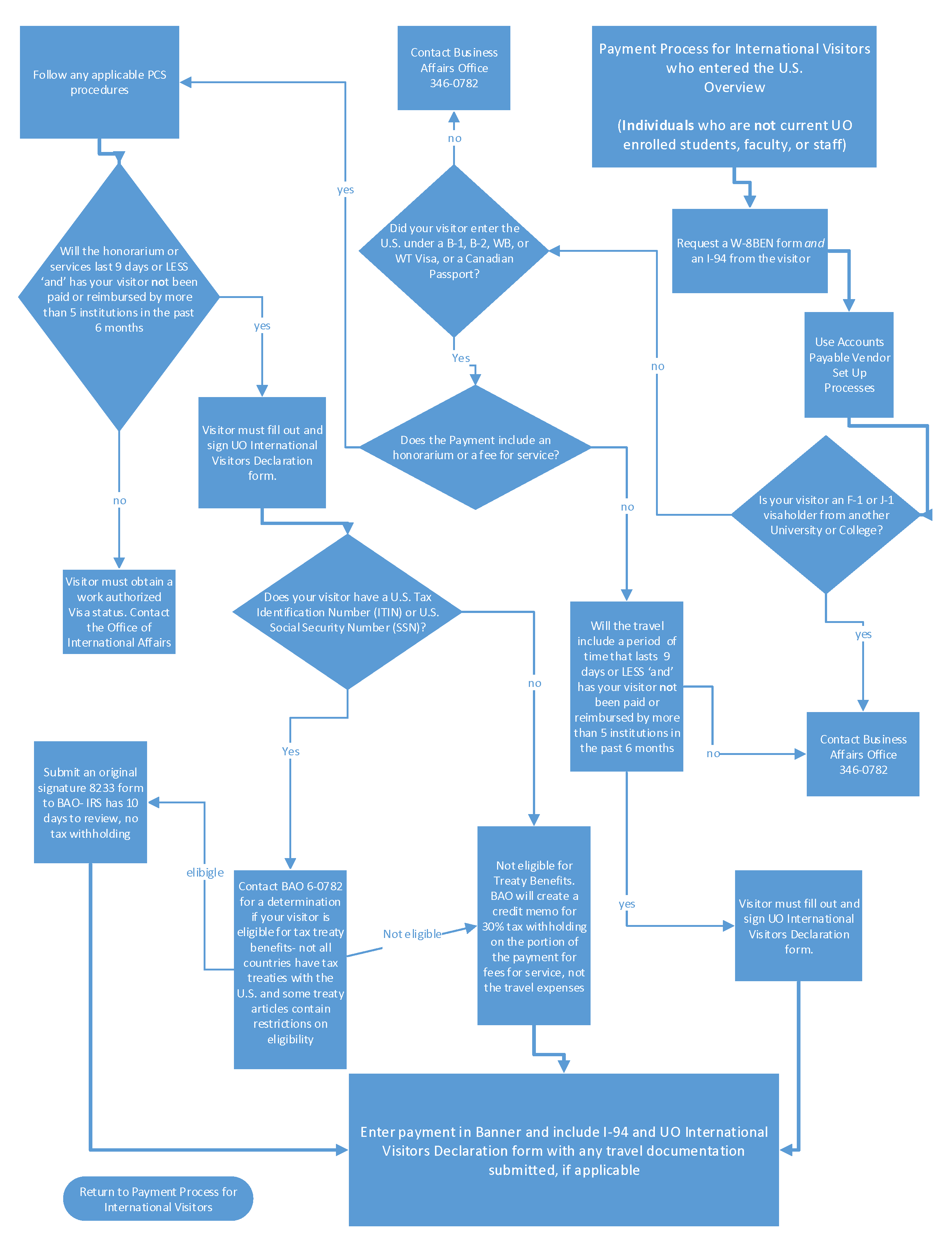

- International Visitor Payment Flow Chart

Notes for Using Check Vendor Function and Sending Checks Outside U.S.

Check Vendor Function Foreign Vendors: Any application Tax withholding must be entered inside the Banner invoice as a negative sequence. Contact Joy Germack in Teams or jgermack@uoregon.edu for more instructions.

Mailing Checks: Be sure to verify with international visitor that they can receive AND cash a paper check issued by the University of Oregon and mailed to their permanent address. Mailing systems are not always reliable and there are many European countries that are not cashing U.S. checks. See Accounts Payable overview on Outgoing Payments to Foreign Countries.

Back to TopPayments or Reimbursements to International Individuals

All international visitors receiving travel expenses paid or reimbursed by the University of Oregon for travel inside the U.S. are required to provide the Initiating Department with a U.S. Homeland Security I-94 document. This document is not available until after they enter the U.S.

There are restrictions regarding which visa types allow for the performance of services inside the U.S. with additional USCIS restrictions on how long and what type of services can be performed and for whom.

International visitors providing services inside the U.S. with a B-1, B-2, WB, WT, or ESTA visa type must also provide a Signed* University of Oregon International Visitor Declaration Form (IVD)

*Signed by both the visitor and the Department. This is an attestation that they have met the no more than 5 other schools in the past 6 months and limited to 9 days of services (5/6/9).

The U.S. Homeland Security I-94 and the IVD forms (if both are required) are to be kept either in the Initiating Department’s files or as an attachment in a Concur travel report. Do not send them to Accounts Payable. When there is no Concur Travel Report, the forms belong in Department's files, and the Banner Invoice Text Field must contain a statement that these two forms can be found in the Department's files.

Foreign individuals or entities providing services outside the U.S. are not subject to U.S. taxation.

Tax Withholding:

Unless the vendor provides to Accounts Payable department (A/P), via their Secure One Drive folder, either - a W-8ECI, attesting they are effectively connected with a permanent establishment inside the U.S. ; OR is able to provide a valid 8233 form To University Business Affairs - Tax Services department that includes a U.S. Taxpayer ID number and that formally claims treaty benefits in additional to their W-8BEN form sent to A/P, there will be 30% federal tax withholding reducing the payment and the vendor would only receive 70% of their invoice. If the department chooses to cover the tax withholding, the grossed-up tax rate is 42.857%.

Any taxes withheld are paid to the IRS in the vendor’s name, and a Form 1042-S showing the payment and the tax withholding will be mailed by the University to the International Visitor after the end of the current and before March 15th of the subsequent calendar year. The vendor may then use the information on the 1042-S form to file a U.S. tax return with the IRS and request a possible refund.

Travel:

Travel expenses reimbursed or paid for directly to a third party are not subject to tax as long as they are compliant with the University of Oregon Travel Policy and procedures and the U.S. non-immigration and tax regulations. International visitors are required to provide a copy of their I-94 (available after they enter the U.S. for this visit.)

And if the Visitor is providing services (paid or unpaid), there are additional restricitons.

H-1b visa, non-UO sponsored, cannot perform services for the University.

B-1 or B-2 or WT or WB ESTA visa requires is a signed UO International Visitor Declaration (IVD) form.

F and J visas require prior approval from their school's USCIS Responsible Officer in writing.

Keep all supporting documentation in the visitor's Concur Travel report. If there is no Travel report, Keep the documents in the initiating department's files, and a statement to this fact needs to be noted in the Banner invoice Text Field that these forms are on file with the initiating department. All documentation is subject to review by University Business AffairsTax Services.

Background

The American Competitiveness and Workforce Act provided the ability to pay reimbursements for expenses and honoraria to international visitors engaged in academic activities within a limited set of circumstances. In addition to work authorized visa types such as H, J, O; we are now able to pay visitors who entered the U.S. with a "B" visa type, (B-1, B-2, combination B-1/B-2, W-T, W-B, and combination W-T/W-B) within certain restrictions. To do so, the International Visitors Declaration Form will need to be completed that indicates the activity and that the individual met all requirements. More information can be found in IRS Publication 515

Back to TopTerminology and some Common Visa Restrictions

If your international visitor will be here for an extended period of time, please contact the Global Engagement International Student and Scholar Services at least 6 weeks before the scheduled visit. They will help you obtain the appropriate J-1 visa paperwork (DS-2019) to send to your visitor. Your visitor will use the DS-2019 to get the correct visa from the U.S. Embassy in their home country. The most common J-1 Visa enables the visitor to work and receive proper payment.

Visa:

An official endorsement to enter, leave, or stay in the U.S. for a specified period of time. This may be a special page or a stamp in the visitor’s passport or it is on the I-94 form showing the visa type under which they entered the U.S. for this, their most current visit.

ESTA:

An 'electronic system for travel authorization' used by the U.S. It is not a type of visa.

An approved travel authorization is not a visa. It does not meet the legal or regulatory requirements to serve in lieu of a United States visa when a visa is required under United States law. Individuals who possess a valid visa will still be able to travel to the United States on that visa for the purpose for which it was issued. Individuals traveling on valid visas are not required to apply for a travel authorization.Form I-94:

The U.S. Arrival and Departure Record issued by a Customs and Border Protection (CBP) Officer to foreign visitors upon their entering the United States. A copy of their I-94 form can be obtained by the visitor on the U.S. Homeland Security's website after entering the U.S. for this visit.

B-1, WB Visa*:

Visitor for business purposes. In order to assist your visitor to enter the U.S. with a W-B or B-1 business visa type, you will need to provide them an official letter of invitation on University of Oregon letterhead, signed by a UO employee, which contains your visitor's name, the dates and subject of the invitation before they travel. They are then able to present this letter to the pertinent authority requesting that they grant your visitor a "visitor for business" B visa type. They may be from a country that is participating in the Visa Waiver Program, or already have a valid ongoing visa (extended term), in which case they would present the letter to immigration official at the port of entry. It is possible they may be required to get a new visa from the U.S. Embassy in their home country.

WB is equivalent of B-1 visa for visitors residing in a visa-waiver country.

B-2, WT Visa*:

Tourist, visitor visa type. WT is equivalent of B-2 visa for visitors residing in a visa-waiver country.

*B-1, WB, B-2, & WT ESTA international visitors may only work for the University for a total of 9 days. And they must attest that they have not worked for more than 5 other U.S. Universities or colleges in the past 6 months. See the University of Oregon's International Visitors Declaration Form.

F-1 and J-1 Visa:

These students are sponsored by the University of Oregon already have their visa documentation on file with Global Engagement International Student and Scholar Services.

W-8 Forms:

There are only two W-8 forms available for use by international visitors / individuals:

- The W-8BEN form (does not require a U.S. Taxpayer ID number)

- Or the much less commonly used W-8ECI form (U.S. Taxpayer ID number is required.)

Tax Withholding:

Any amount of taxes withheld from a payment will be paid to the IRS in the name of the recipient of the payment. After the end of the current calendar year, the recipient will receive a 1042-s form from the University of Oregon showing the payment and withholding amounts.

Bonafide Volunteer:

To qualify, an individual must have special skills, knowledge, or information, and their services would normally be paid for, and they must agree to volunteer their services.

Bonafide volunteer's travel expenses can be paid or reimbursed tax-free per the IRS IRC Section 457(e)(11)(B)(i).

To qualify, a Bonafide volunteer must have special skills, knowledge, or information, and their services would normally be paid for, and they must agree to volunteer their services.

Volunteer's relationship with the University can be documented by:

- A notation in the Concur Travel report that the Volunteer Form was submitted to the Safety and Risk Department for this individual.

- Or - An invitation letter that indicates:

- What the volunteer is being asked to do &

- States that there will be no payment or compensation offered &

- Describes what costs if any will be covered

- Or - A zero dollar on travel expenses Purchase Order can be created, but this also requires a copy of their emailed invitation that indicates only travel expenses will be paid.

Amending an existing Personal Services Contract that contains an honorarium to cover travel expenses only does not create Bonafide volunteer status.

Treaty Benefits for Independent Personal Services (Form 8233)

Request for treaty benefits for an international visitor providing services - IRS Form 8233 required.

Although no one can take treaty benefits away from residents of tax treaty countries providing services inside the U.S., the University of Oregon is required per U.S. federal regulations to obtain a valid 8233 form before provide tax treaty benefits up front. Without a valid Form 8233, the University is required to withhold 30% federal tax and pay taxes withheld to the IRS in the International Visitor's name. The Visitor may then use the information provided on their Form 1042s to prepare and file a U.S. tax return to obtain their treaty benefits from the IRS. And the IRS will refund all taxes withheld to them. The University will mail the Form 1042s form to all International Visitors after the end of the current and before March 15th of the subsequent calendar year.

The IRS Form 8233 is used by international visitors, who are residents in countries that have a tax treaty with the U.S. Treaty benefits claim a reduced rate of tax on independent personal services that are performed inside the U.S. This form requires the visitor to have a U.S. Taxpayer Identification Number (TIN or SSN). If there is an applicable tax treaty, and your international visitor has a U.S. Taxpayer ID number, and they formally claim treaty benefits; the tax withholding is reduced to 0%.

List of Countries with US Tax Treaties

Treaty Benefits for individuals require a signed International Visitors Declaration Form and a copy the visitor's I-94. These two forms are required to be kept in the initiating department's files or within a Concur Travel report .

To submit a valid, completed Form 8233 (instructions) please contact Joy Germack, University Business Affairs - Tax Services, for assistance. The form is not user friendly.

- Send International Vendor a link to the form above.

- International Visitor fills out form as best they can. All fields/lines are required including calendar year at the top. And send Draft Form 8233 unsigned to you using a Secure One Drive Link

- Share One Drive Link with Joy Germack, Tax Services, University Business Affairs 541-346-0782

- A Tax review of the draft will generate a request for any missing information that needs to be added by vendor or will be approved for signature by the vendor.

- A Hard Copy with a wet signature signature on the Form 8233 must must be received by Tax Services before treaty benefits reducing tax withholding to 0% will be approved. Research is ongoing for use of IRS approved signature software such as Docusign.

- Once corrected, finalized, and signed, send a copy of 8233 form ( with an electronic, valid signature) via Secure One Drive back to Tax Services/Joy Germack

- Tax Services will fax the copy of the form to the IRS for their 10 working day review (required). This form generates either a disapproval or a negative assurance.If the IRS has sent no notice to University Business AffairsTax Services after the 10 working day review period, the payment can go out without tax withholding.

- Create the Banner invoice to make the payment (0% tax withholding) using a "payment date" of 10 working days after Tax Services receives and faxes the 8233 to the IRS.

- The Banner invoice paying the international visitor can be created at any point after the vendor has been set up by Accounts Payable. See Banner invoice payment procedure. But the payment date must be set up to be both after the original signature paper form has been receiving by your department and provided to Tax Services 'and' 10 working days after the completed 8233 form has been faxed to the IRS. After that the payment goes out with 0% tax withholding.

- Once Tax Services has approved and faxed the 8233 form to the IRS, after the 10 day review window, there is no confirmation provided that they approved the form. If no IRS rejection letter is received from the IRS in the 10 day period; the 8233 form is valid. And in this case, Tax Services will allow payment to go out tax free, but there will be no confirmation notice sent to the department. If the initiating department receives no email from Tax Services that the 8233 is invalid within the 10 days, they can release the payment, tax-free. It will be up to the initiating department to count and determine when the 10 day period has passed.

Artists / Athletes Treaty Benefit, Addtional Limitation

Many countries have tax treaties that contain a restrictive limit (once the threshold is exceeded, treaty benefits are rescinded) on the annual amount an artist can earn during a calendar year while inside the U.S. Due to the fact that the treaty benefits becomes null and void if the limit is exceeded, the University of Oregon is not able to give treaty benefits up front to artists from countries that have this limitation in their tax treaty with the U.S. Visiting international artists will have to get their treaty benefits from the IRS.

Back to TopTable of Taxes, Travel Restrictions, and Documents Required for International Visitors

IRS overview for amounts subject to reporting on Form 1042-S for tax withholding/reporting purposes and tax reporting when treaty benefits are formally claimed.

Obtaining a copy of a Canadian passport can be a valid replacement for an I-94, and it is a required document when traveler is filing out an 8233 form claiming independent personal services treaty benefits.

See Current Tax Table spreadsheet for printable versionof table below.

| Payment Type (#) | Visa Type Entered U.S. With (Most Recently) | Restrictions | Tax Withholding Rate | Documents Required from International Visitor | Treaty Benefits Requirements |

|---|---|---|---|---|---|

| International Visitor: Honoraria or Contract fees for Services with or without Travel Expenses (1) | Business visa: B-1 or WB (ESTA) | IVD: Visitor has not received honoraria from more than 5 other institutions in the past 6 months and no more than 9 days of service (does not have to be consecutive) | 30% (or 42.857% grossed up) |

*Tax Free Travel expenses must meet UO Travel Policy and can include the Room & Board expenses for any interval non-service days. Form I-94 is available after visitor enters the U.S. | Treaty Benefits reduce tax withholding to 0%. A valid signed Form 8233 requires Treaty exists and the Visitor has a U.S. Tax ID Number or SSN. Payment can only be released the 11th day after 8233 is faxed to IRS by Tax Services. (Banner invoice can be created earlier with a later payment date.) Valid signature requires original hardcopy in U.S. mail or DocuSign electronic software. |

| International Visitor: Honoraria or Contract fee for Services with or without Travel Expenses (2) | Tourist visa: B-2 or WT (ESTA) | IVD: Visitor has not received honoraria from more than 5 other institutions in the past 6 months and no more than 9 days of service (must be consecutive) | 30% (or 42.857% grossed up) |

*Tax Free Travel expenses must meet UO Travel Policy BUT CANNOT include the Room & Board expenses for any interval non-service days. Form (I-94) is available after visitor enters the U.S. | Treaty Benefits reduce tax withholding to 0%. A valid signed Form 8233 requires Treaty exists and the Visitor has a U.S. Tax ID Number or SSN. Payment can only be released the 11th day after 8233 is faxed to IRS by Tax Services. (Banner invoice can be created earlier with a later payment date.) Valid signature requires original hardcopy in U.S. mail or DocuSign electronic software. |

| International Visitor: Honoraria or Contract Fee for Services with or without Travel Expenses (3) | Any other Visa Types (other than a B-1, or B-2, or WB, or WT) such as an F-1 and J-1 visas not sponsored by the UO | Some visa types do not allow payment from non-sponsoring entities or require their sponsor's written approval. *Contact Tax Services to verify that the visitor's specific Visa Type can be paid Honoraria. | 30% (or 42.857% grossed up) |

*Tax Free Travel expenses must meet UO policy and PO or PSC include honorarium. Form I-94 is available after visitor enters the U.S. | Treaty Benefits reduce tax withholding to 0%. A valid signed Form 8233 requires Treaty exists and the Visitor has a U.S. Tax ID Number or SSN. Payment can only be released the 11th day after 8233 is faxed to IRS by Tax Services. (Banner invoice can be created earlier with a later payment date.) Valid signature requires original hardcopy in U.S. mail or DocuSign electronic software. |

| International Visitor: Travel Expenses only Services provided as a Bonafide Volunteer (4) | Business visa: B-1 or WB (ESTA) | IVD: Visitor has not received honoraria Travel expenses from more than 5 other institutions in the past 6 months and no more than 9 days of service (must be consecutive) | 0% |

*Tax Free Travel expenses must meet UO policy and the Concur Travel Report must include either: Form I-94 is available after visitor enters the U.S. | |

| International Visitor: Travel Expenses only Services provided as a Bonafide Volunteer (5) | Tourist visa: B-2 or WT (ESTA) | IVD: Visitor has not received honoraria Travel expenses from more than 5 other institutions in the past 6 months and no more than 9 days of service (does not have to be consecutive, but out of pocket expenses if more than 9 days are subject to 30% tax withholding) | 0% |

*Tax Free Travel expenses must meet UO policy and the Concur Travel Report must include either: Form I-94 is available after visitor enters the U.S. | |

| International Visitor: Travel Expenses Reimbursed Paid-only Services provided as a Bonafide Volunteer (6) | Visa Type is not a B-1,B-2,WB, or WT | Some visa types do not allow payment from non-sponsoring entities. *Contact Tax Services to verify that the visitor's specific Visa Type can be paid Honoraria. | 0% |

Form I-94 is available after visitor enters the U.S. | |

| International Visitor: No Services. Travel Expenses only. Scholarships, fellowships, travel awards (7) | F/J/M/Q visa that is not sponsored by the UO | Coded 2863X - stipend J:Approval letter from their sponsoring University's Responsible Officer (SEVIS) | 14% (or 16.279% grossed up) |

Form I-94 is available after visitor enters the U.S. | no treaty benefits available |

| International Visitor: No Services. Travel Expenses only. Scholarships, fellowships, travel awards (8) | International Visitor with Visa type that is not F/J/M/Q | Coded 2863X - stipend | 30% (or 42.857% grossed up) |

Form I-94 is available after visitor enters the U.S. | no treaty benefits available |

| University student, student employee, or courtesy appointment with UO ID number. No Services. Travel Expenses only. Scholarships, fellowships, travel awards (9) | UO Sponsored F-1 or UO Sponsored J-1 | Coded 5XXXX - stipend | 14% (or 16.279% grossed up) | Signed W-8BEN to Accounts Payable. There may already be one on file. Current F-1 and J-1 visa students and scholars sponsored by the University of Oregon already have their visa documentation on file with Global Education. No I-94 attachment is required. | Treaty Benefits reduce tax withholding to 0%. Requires Treaty Article for students exists, visitor has a U.S. Tax ID number or SSN, and Part II of W-8BEN filled out correctly. Valid signature cannot be typed. |

| University student, student employee, or courtesy appointment with UO ID number. With restricted services. (10) | UO Sponsored F-1 or UO Sponsored J-1 | Only services allowed are presentation of paper or poster, travel is associated with student employee's duties. | 0% | Signed W-8BEN to Accounts Payable. Current F-1 and J-1 visa students and scholars sponsored by the University of Oregon already have their visa documentation on file with Global Education. No I-94 attachment is required | Coded 35XXX student presenting a poster or paper, or work related travel by a student employee. |

| Monetary Awards for competitions. No services. (11) | All Visa Types 30% applies to Awards that are not education related scholarship/fellowships | Not a scholarship/fellowship | 30% (or 42.857% grossed up) | If entered the U.S., Copy of most current I-94 form (or Canadian Passport copy) | No treaty benefits allowed |

Note: H-1B visa holders from other Universities or colleges (not sponsored by the UO) are not permitted to engage in activities for entities other than their visa sponsor. They must have received USCIS approval for a “concurrent’ H-1B through UO before they can be paid an honorarium or TRAVEL Expenses (NEW tax law). They are permitted to make occasional speeches and give lectures at other institutions or conferences, but may not be reimbursed for “transportation and reasonable, incidental expenses” incurred in connection with travel to other institutions or conferences. You will need to make arrangements to pay their sponsor directly.

The grossed-up tax rate of 42.857% is an additional expense that when added to the original payment allows the recipient to receive 100% of expected payment after the required tax withholding.

If you have any questions or if your international visitor entered the U.S. under any other visa type besides B, F, or J; please contact Joy Germack at jgermack@uoregon.edu.

Back to TopW-8 Form: Setting up an International Individual Vendor in Banner

We all of us want to get vendors set up as quickly as possible. While the W-8 forms are different than the W-9. And they are only valid for 3 years.There are some required lines that cannot be blank. I am hoping to save your department and A/P time by sharing these few required differences.

A Department can save valuable time by providing A/P department (via a Secure One Drive Link) a W-8BEN or W-8BEN-E form, the two most common W-8 forms used by the UO's vendors, that has been double checked to have a signatures with the box above the signature line check.

Note: W-8 forms that contain any information that is written or typed in a manner that is inconsistent with the rest of the form are not acceptable and will be returned to the initiating Department.

General form requirements below are per the IRS official guidance. The A/P department cannot give exceptions to these requirements. And will have to return the W-8 to you for correction before vendor can be set up.

Procedure for Individuals

Collect the appropriate W8 form from the individual. An individual may only fill out one of two forms, the W-8BEN or the W-8ECI. The vendor may determine the appropriate form by following the criteria outlined at the top of each of the forms or their instructions. See Central Accounts Payable and Invoice Payments under UO Forms for W-8 forms and information.

The W-8BEN is the most common form used by foreign individuals. This form may be used to claim foreign status and can also be used to claim treaty benefits, if available, but only for royalty/passive income or scholarships/fellowships.

W-8BEN Form: (individuals only)

Minimum requirements, must be filled out.

- Valid version is Rev. October 2021, top left of form.

- There is space for two addresses, vendor's foreign address and a mailing address, but only their permanent address outside the U.S. is required.

- The Foreign Taxpayer ID must be provided line 6a or the box checked line 6b, but vendor must provide their FTIN on line 6a if they are providing services to the University.

Example: A vendor from Germany, provides their Germany Tax ID Number - The box above the signature must be checked, and

- the signature cannot be typed in.

- Treaty Benefits on W-8BEN form only available to UO students with SSN or U.S. TIN.

- A birthdate is required on the W-8BEN form.

- A U.S. Tax identification number is not required unless treaty benefits are requested.

- Part II, lines 9 and 10 are not required unless treaty benefits are allowed.

- Treaty Benefit requests for an exemption from tax withholding must be made "form"ally and do require a U.S. Individual Taxpayer Identification Number or a U.S. Social Security Number.

- Not all countries have a tax treaty with the U.S., and not all tax treaties contain a tax exemption for student scholarships/fellowships.

- Royalty or scholarships/fellowships Treaty Benefits requests can be made using the W-8BEN form and require completion of all fields in lines 9 and 10.

- Independent personal services or honorarium Treaty Benefits requests can only be made one an 8233 form. The 8233 form requires U.S. taxpayer identification number. Otherwise, these payments will require 30% tax withholding. All taxes withheld are paid to the IRS in the individual's name. See 1042-s reporting. Contact Joy Germack at jgermack@uoregon.edu for assistance with the 8233 form.

W-8ECI Form: Used primarily by the payee or beneficial owner that all the income that is listed on the form is effectively connected with the conduct of a trade or business located within the United States.

- The type of income must be identified on Line 9 of the form to qualify for exemption. If it is not listed, we are required to obtain from the entity a different type of W8 form.

- A U.S. tax identification number is required for exemption from tax withholding.

Virtual Services

Per federal regulations, U.S. taxes are applied to payments to foreign vendors depending on where the services take place, not their permanent residence address. It is important to add, into the text of the Banner invoice, the vendor's physical location during the virtual presentation. i.e., inside or outside the U.S. to the Banner invoice text field when making payment.

If the provider of the service is an international individual (non-U.S. person) who did not enter the U.S. to perform the services, then there are no U.S. tax consequences; use account code 24999.

If the vendor is visiting and is physically inside the U.S. during their virtual presentation, 30% tax withholding will be applied per federal regulations unless treaty benefits are formally requested on an 8233 form or a W-8ECI form is provided.

Back to TopForm 1042-s for Foreign Vendors

Form 1042-s is used to report income described under Amounts Subject to Reporting on Form 1042-S and to report treaty benefits or amount of tax withheld.

All taxes withheld from payments are paid to the Internal Revenue Service (IRS) in the vendor's name. IRS form 1042-S is used to tax report the gross amounts paid to and taxes withheld from foreign persons or foreign entities that are subject to income tax reporting, even if no amount is deducted and withheld from the payment due to a treaty benefit. The 1042-S forms must be sent by the University of Oregon to both the IRS and to the recipients by March 15 of the year following the calendar year in which the income subject to reporting was paid. If March 15 falls on a Saturday, Sunday, or legal holiday, the due date is the next business day. The University will make every effort to have these forms in the mail sooner than the due date.

Vendors may use the information provided on from 1042-s to fill out a U.S. tax return to claim treaty benefits and request a refund from the IRS.

Back to TopInternational Visitor Payment Flow Chart

Last updated 05/07/2025

Back to Top