Internal Sales, Transfers, and How to Move Revenue & Expense

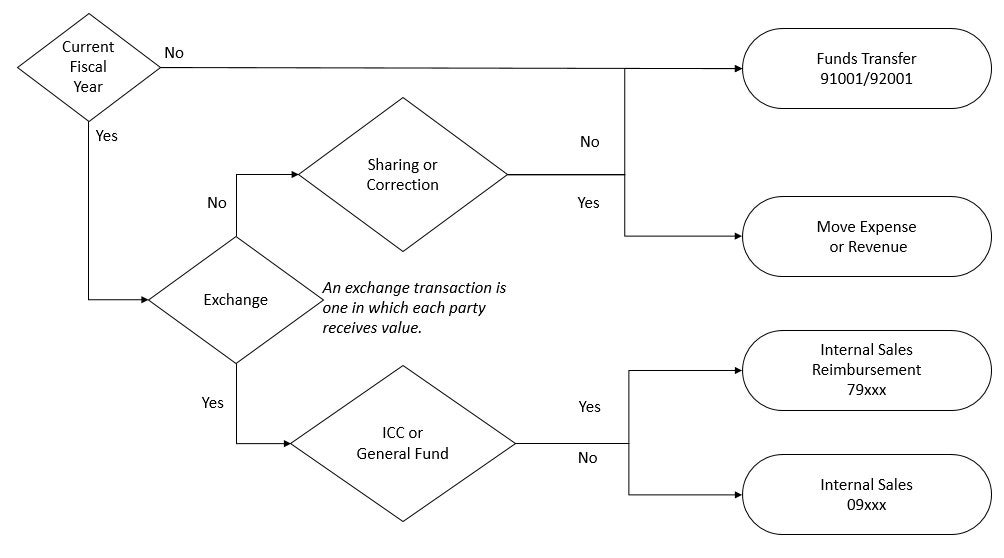

There are several ways to move cash or budget between funds, organizations, account codes, programs, activities, or locations (FOAPAL) in Banner. Each of these methods is described below.

Moving Expense or Revenue

A journal voucher (JV) is used to move expense or revenue within the current fiscal year. This procedure is used to change any FOAPAL element that was used on the original document. Below are several examples:

- Correcting the account code charged with a Banner invoice or JV.

- Distributing revenue collected in a single index to a number of more specific indexes within the same fiscal year; or distributing revenue from an unearned revenue account code.

- Moving an expense recorded by Banner invoice to a general ledger prepaid expense account code to be reversed and recognized as expense in a future period

See our Financial Procedures page for procedures for unearned revenue, prepaid expense, and other accruals.

Please note the following in regards to moving expense or revenue:

- It is preferable to allocate expense or revenue between various FOAPAL at the time of the original entry. For example, a Banner invoice can be coded to multiple indexes for a cost being shared by departments.

- The revenue or expense being moved should be identifiable. Use the account codes from the original document, rather than miscellaneous account codes. In addition, provide reference to the original document in either the JV’s document reference field or FOATEXT. Use FGAJVCD for JV transactions involving sponsored project indexes, and include the original document reference in the designated field. For expenses split between multiple sponsored projects, or between sponsored and non-sponsored funds, include a description of the allocation method and how the charge relates to the project in the document text.

- In some cases, sponsored projects funds (Fund Types 31 – 35) or plant funds (Fund Types 81 & 83) may move expense across fiscal years. If moving sponsored project expenses more than 90 days after the original transaction date, submit a Cost Transfer Justification Form to Sponsored Project Services.

- Payroll expenses may be moved with a payroll accounting adjustment (PAA or PHAREDS) within the current fiscal year.For sponsored projects, payroll accounting adjustments may be required from prior fiscal years.Contact Sponsored Projects Services for guidance.

- The revenue or expense that is moved cannot conflict with any restrictions on the source of funds or allowable expenses of a particular fund. See Fund-Account Code Matrix for proper use of account codes with funds. For example:

- Restricted sponsored projects and gift funds may only be used for expenses allowed based on the restrictions of the sponsor, contracting agency, or donor.

- Typically, sponsored projects and gift funds only accept sponsored project or gift revenue, respectively.For revenues or credits allocable to sponsored projects indexes, contact Sponsored Projects Services for guidance.

- The general fund (001100) does not accept revenue other than centrally collected tuition, fees, state appropriations and reimbursements from outside entities.

Internal Sales & Internal Sales Reimbursements

Internal sales and internal sales reimbursements are used to record exchange transactions within the University of Oregon (UO). An exchange transaction is one in which each party receives value. (i.e. Science Stores sales, Housing conference space rentals, Campus Planning & Facilities Management administrative fees, etc.). When recording an exchange transaction in Banner add text that describes the substance of the exchange.

- Credit Internal Sales Reimbursement account codes (79xxx) in the General Fund (001100) and ICC Credits Fund (001700).

- Credit Internal Sales account codes (09xxx) in the following fund types: Income/Expense, Continuing Education, Designated Operations, Service Departments, and Auxiliaries.

- The debit side of an internal sales or internal sales reimbursement transaction should be an expense.

- Gift funds, Invention/Royalty funds, and Sponsored project funds should not have internal sales. For credits that potentially belong to a sponsored project fund, please contact Sponsored Projects Services for guidance.

Fund Transfers

Fund transfers are used to move cash between funds when there is not an exchange transaction. They are also used to move fund balance created by revenue or expense from a prior fiscal year. In addition to moving cash/fund balance, a fund transfer usually includes a budget change. The following are common examples of fund transfers:

- Transfering to a fund to correct a negative fund balance.

- Moving a fund balance in order to terminate a fund.

- Providing support to another department without receiving anything in return.

- Providing financial support to a service center.

- Correcting prior year expense or revenue (except prior year capital expense (40XXX) corrections, they should be made directly to capital expense account codes).

- Transferring cash to a plant fund for a construction project.

- Transfers from a restricted gift fund to another restricted gift (Fund Type 36) is only allowed when a parent/child fund setup exists - contact your BRP Financial Analyst for assistance.

- Transfers to and from sponsored funds are atypical for sponsored projects indexes, and can only be completed by Sponsored Projects Services.Contact Sponsored Projects Services for guidance.

Transfer account codes:

- 91001 & 92001 – Transfer In From/Out To Other Funds

- 91008 & 92008 – Tfr In/Out - Debt Retirement w/in Inst

Budget Changes

A budget change moves budget within the same fund. Budget changes are temporary (lasting only the current fiscal year) or permanent (lasting from this point on). A budget change does not move cash. Examples include, but are not limited to the following:

- Moving budget between organizations.

- Funding a current year budget deficit.

- Startup support from the Vice President for Research & Innovation.

- Budget changes on sponsored projects indexes may require sponsor approval, and therefore must be requested from and completed by Sponsored Projects Services.

For more information on fund transfers and budget changes, contact your Budget and Resource Planning (BRP) Analyst or visit the BRP website.

Frequently Asked Questions

- How do I account for support provided for an event that is being paid for from a gift fund?

- If possible, share expenses of the event with the department providing support at the time invoices are paid. Alternately, expenses associated with the event already recorded in the gift fund can be moved to the supporting fund. These expenses could be tracked utilizing an activity code for the event.

- If sharing the expense of the event is not possible, determine if the support received is an exchange transaction or not. If the department providing support gets something in return (i.e. their name in the program), it is an exchange transaction and should be accounted for as an internal sale or internal sales reimbursement. If there is no consideration provided, it is a nonexchange transaction and should be accounted for with a fund transfer.

- In either situation, the internal sale or transfer-in should not be recorded in the gift fund. The best option would be to run the event through a designated operations fund. If additional funding from your gift fund is needed, it can be moved to the designated operations fund with a fund transfer (if permitted by any donor restrictions).

- In all of the above instances if the event being supported is from a prior fiscal year, then it should be accounted for with a fund transfer.

- How do I account for a professor from my department teaching a class for another department – a course buyout

- A payroll redistribution should be done during the term the class is taught to distribute the amount that is agreed upon between the two departments. It is important to remember that OPE will follow the payroll that is redistributed.

- How do I account for support provided for an event that is being paid for from Academic Support Accounts (ASA)?

- If possible, share expenses of the event with the department providing support at the time invoices are paid. Alternately, expenses from the current fiscal year associated with the event can be moved to the supporting fund. If the expenses are from a prior fiscal year, then use a fund transfer.

- These expenses could be tracked utilizing an activity code for the event. In this case, sharing the expense of the event may not be possible, because the professor’s activity code is used to track ASA funds. In that case, determine if the support received is an exchange transaction or not. If the department providing support gets something in return (i.e. their name in the program), it is an exchange transaction and should be accounted for as an internal sale or internal sales reimbursement. If there is no consideration provided, it is a nonexchange transaction and should be accounted for with a fund transfer.

- What are the transactions needed to prepare a fund to be terminated?

- In order to terminate a fund, it must have no fund balance. Typically, a fund transfer is used to move any minor remaining fund balance in preparation to terminate the fund. For example,

- Debit Index for fund to be terminated 92001 $X.XX (remaining fund balance)

- Credit Index that fund balance is moving to 91001 $X.XX

- In order to terminate a fund, it must have no fund balance. Typically, a fund transfer is used to move any minor remaining fund balance in preparation to terminate the fund. For example,